Part 1: Child Support Overview

Part 2: Get Started and Enter Essential Details

Part 3: Spousal Support and Spousal Maintenance Adjustments

Part 4: Non-Joint Children Adjustments

Part 5: Support Obligation Adjustments

Part 6: Comments, Settings, and Exporting

Support Obligation Adjustments

This post follows Part 4: Non-Joint Children Adjustments in Legal Thunder’s 2025 Guide to Calculate Child Support in Colorado series. This post assumes that the previous parts in the series have been reviewed and steps prior have been completed. This part 5 focuses on adjustments to the monthly support obligation based on certain other expenses and circumstances.

The expenses in this section are placed on the child support worksheet and allocated among the parties in proportion to their adjusted gross incomes. In other words, by putting an expense into this section, both parties end up paying for the expense in proportion to their adjusted gross incomes – the basic child support obligation gets adjusted up or down depending on which party pays the expense and receives credit for fronting the other party’s proportionate share.

This post will show some examples after explaining each potential adjustment category. The categories of expenses which can adjust the monthly support obligation are as follows:

- Work-related child care costs

- Job search or education-related child care costs

- The children’s portion of health insurance premiums

- Consistent and ongoing extraordinary medical expenses

- Other regular and consistent expenses that are subject to allocation by agreement of the parties or pursuant to sections 115(9)-(11) of Colorado’s child support statute

Click on > Support Obligation Adjustments to open up this section.

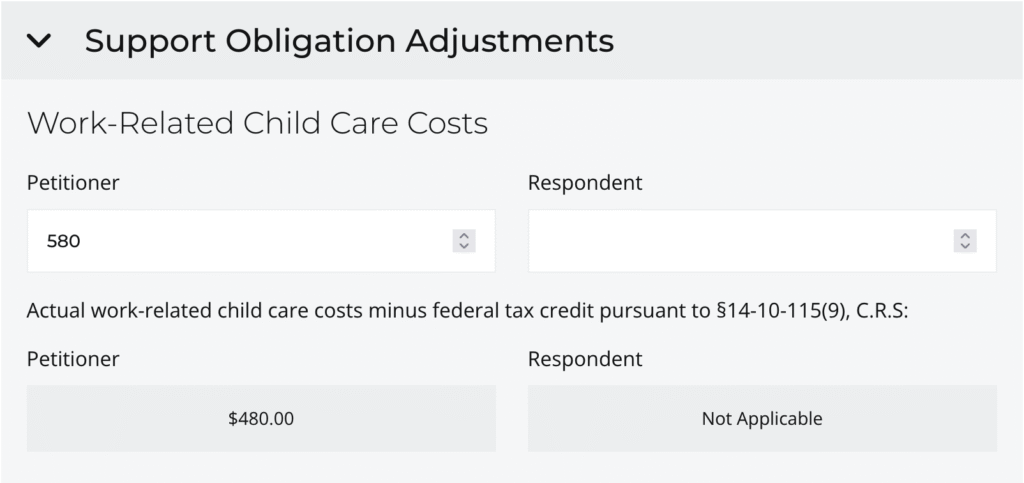

Work-Related Child Care Costs

The first subsection to review is Work-Related Child Care Costs. Except as otherwise agreed upon by the parties in their court orders, child care expenses (for the subject children) necessary for a party to work, find work, or receive education are subject to allocation among the parties in proportion to the parties’ incomes, regardless of whichever parent needed the child care. C.R.S. § 14-10-115(9).

Remember that entering the child care expenses into the adjustment calculator here will automatically allocate the expense in proportion to the parties’ adjusted gross incomes – if the parties have a court-ordered agreement to divide the cost differently (for example, equally no matter what their proportion of incomes are) or if the parties’ court-ordered agreement expressly states that each party should pay their own child care costs, it would not be appropriate to include this adjustment on the child support worksheet calculation. If you are not sure whether child care costs can be included on the worksheet, review your orders, review the child support statute, or ask your attorney or limited license paralegal.

When entering work-related child care costs, federal income tax credits for child care must be subtracted, pursuant to section 14-10-115(9), C.R.S.. Enter the full amount paid; our calculator will subtract the federal income tax credits and the resulting adjustment will be displayed below. Please note that, for purposes of this adjustment, the statute caps the costs at “the level required to provide quality care from a licensed source.” § 115(9). There is no specific price limit for this in Colorado’s statutes – it will depend on the costs for such licensed care available in the applicable area.

Job Search or Education-Related Child Care Costs

As mentioned above, except as otherwise agreed upon by the parties in their court orders, child care expenses (for the subject children) necessary for a party to work, find work, or receive education are subject to allocation among the parties in proportion to the parties’ incomes, regardless of whichever parent needed the child care. C.R.S. § 14-10-115(9).

If the child-care costs are for the party’s pursuit of employment or education, the federal income tax credits would not be applicable, as they would be for work-related child care costs. For this category, enter the full amount paid by the party in the subsection specifically for education-related child care costs, and the calculator should apply the adjustment as entered. As noted above, for purposes of this adjustment, the statute caps the costs at “the level required to provide quality care from a licensed source.” § 115(9). There is no specific price limit for this in Colorado’s statutes – it will depend on the costs for such licensed care available in the applicable area.

Remember that entering the child care expenses into the adjustment calculator here will automatically allocate the expense in proportion to the parties’ adjusted gross incomes. Accordingly, if the parties have a court-ordered agreement to divide the cost differently (for example, equally no matter what their proportion of incomes are) or if the parties’ court-ordered agreement expressly states that each party should pay their own child care costs, it would not be appropriate to include this adjustment on the child support worksheet calculation. If you are not sure whether child care costs can be included on the worksheet, review your orders, review the child support statute, or ask your attorney or limited license paralegal.

Children’s Health Insurance Premiums

When a party pays the children’s portion of the health insurance premiums out of pocket, those costs are typically included in the child support worksheet calculation and the child support obligation is adjusted to ensure both parties contribute their proportionate share. Pursuant to section 14-10-115(10)(c), C.R.S., the amount placed on the worksheet for this purpose must be the actual amount attributable to the child or children subject to the case.

The children’s portion of the insurance premiums is the difference between what the party would pay if not covering the children and the cost of including the children in the coverage. This can be demonstrated by showing the breakdown of cost of different health plan options available through the insurance carrier – usually illustrated in a document sent by your employer’s HR department or through the marketplace (if self-employed) during the open enrollment period. For example, if the out of pocket cost would be $250 per month for the party to cover only themselves and the total out of pocket cost to include themselves and the children would be $350, the children’s portion of the cost would be $100 ($350 – $250).

If that specific cost difference cannot be demonstrated or is not available, the statutory formula to determine the children’s portion of the insurance premiums is to take the total out of pocket monthly premiums, divide it by the number of people covered by the plan, and multiply that by the number of covered children subject to the order. For example, if a party pays $450 per month for out of pocket health insurance premiums, and there are five people covered on the plan, the cost for the three children subject to the support order would be $270 ($450 / 4 people = $90 per person x 3 children).

Health insurance premiums would include premiums for medical, dental, and vision insurance, but it would not include life insurance. Payments made to a party’s health savings account for out of pocket premiums would not be included either, unless both parties had access to such funds, which is rarely the case.

Extraordinary Medical Expenses

Colorado’s child support statute specifically defines the extraordinary medical expenses which are subject to allocation between the parties in proportion to their incomes. As of May 31, 2025, extraordinary medical expenses include copayments, deductibles, and uninsured out-of-pocket expenses for professional medical care, prescriptions, medical equipment, orthodontia, dental treatment, physical therapy, vision care, and mental health treatment. C.R.S. § 14-10-115(10)(h)(II). Over the counter items like children’s tylenol, cough syrup, bandages, ointments, and similar items that usually stock a medicine cabinet for ordinary care are not considered “extraordinary expenses” unless they are prescribed by a doctor to treat a chronic condition. § 115(10)(h)(II).

Please note that only ongoing and consistent extraordinary expenses should be included in the child support worksheet. C.R.S. § 14-10-115(10)(h)(I). If the expense is NOT the same amount each month or NOT expected to continue for a while, the expense should not be included on the worksheet, and thus should not be included in the calculation as an adjustment. In such instances, the parties are expected to reimburse each other for the expense outside of the regular monthly payment. If the expense will continue to be a regular monthly expense at a predictable amount each month, it may be appropriate to include the expense on the worksheet and the amount paid by a party should be entered into the calculator.

For example, a one time dental treatment that cost $400 may need to be subject to reimbursement outside of the regular monthly payment, but a $3,600 orthodontia plan paid at $100 each month for three years may be appropriate to include on the child support worksheet. Similarly, a child’s monthly psychiatric appointment could be included in the worksheet if the out-of-pocket cost is consistent and expected to continue indefinitely. Keep in mind that if the expense changes, you may need to revisit the calculation to see if the monthly support amount would be modifiable. If you know the expense will change soon, you may decide it would be best to have the expense reimbursed outside of the monthly payment, so you do not have to re-do your support order more often than absolutely necessary or desirable. Remember, child support orders can only be modified by court order – verbal or even written agreements to change the child support obligation are not enforceable until they are formally approved by the Court.

Additional Adjustments

There may be additional consistent and ongoing expenses that should be allocated among the parties in proportion to income by agreement of the parties, court order, or operation of law. These may include school tuition if it is agreed upon or court ordered for the children to attend private school; monthly membership fees for the child’s agreed upon activities like a martial arts club, dance classes, or other agreed upon or court ordered activities that have a predictable, consistent, ongoing monthly cost. Just remember that by putting the additional expenses onto the worksheet, such costs are being allocated between the parties in proportion to their adjusted gross incomes, and the other party’s payment is included in the monthly child support obligation.

Reduction of Need

There are instances in which a parent or child receives funds or other benefits which may reduce the child’s financial needs. While this is not common and typically subject to the Court’s approval, if there is a reduction of need received by one or both parties on behalf of the child, such reduction of need could be added here in the “reduction of need” subsection. Including a reduction of need in this subsection would allocate the reduction of need across both parties’ support obligations in proportion to their incomes. Examples may include a child’s trust income, a child’s employment income, scholarship, or other consistent and quantifiable income/benefit. Do keep in mind that whether a particular benefit or a child’s income reduces the child’s needs is subject to the judge’s discretion. C.R.S. § 14-10-115(11)(b). By way of example, if a judge concludes that the child’s income is being saved for post-secondary education or used by the child for the child’s own discretionary spending or vehicle use, the judge may elect to exclude the child’s income from affecting the parties’ child support obligation. There is no bright-line rule on this category – it depends on what the Court determines to be a reduction of need or not.

Save Your Progress and Continue

Click on the SAVE button to ensure your changes are recorded.

Continue on to the next post in the Guide to Calculate Child Support series at Part 6: Comments, Settings, and Export.

Disclaimer

This guide is intended for informational purposes only and is not a substitute for legal advice. The information provided in this guide is generalized, and every case is different. If you are not sure whether a particular part of this guide should apply to you as described or not, please check with an attorney or limited license paralegal.