Part 1: Child Support Overview

Part 2: Get Started and Enter Essential Details

Part 3: Spousal Support and Spousal Maintenance Adjustments

Part 4: Non-Joint Children Adjustments

Part 5: Support Obligation Adjustments

Part 6: Comments, Settings, and Exporting

Non-Joint Children Adjustments

This post follows Part 3: Spousal Support and Maintenance Adjustments in Legal Thunder’s 2025 Guide to Calculate Child Support in Colorado series. This post assumes that the previous parts in the series have been reviewed and steps prior have been completed. This part 3 focuses on the adjustments made to gross income due to a party’s legal obligation to support non-joint children, i.e. children from a relationship different than the one between the petitioner and the respondent for whom either of the parties has a legal obligation to support. The idea is that a party’s legal obligation to support children from a different relationship impacts the funds available to support the children of the case for which you are calculating support. There are three categories of support considered for non-joint children:

- court-ordered child support

- support for non-joint children living primarily with the party; and

- documented money payments for support of non-joint children when there is no court order.

Please remember that this Guide is not a substitute for actual legal advice. If you are not sure whether a party can claim the adjustment, you can review the language of the statute yourself here: C.R.S. § 14-10-115(6)(b); or you can ask your attorney or limited license paralegal.

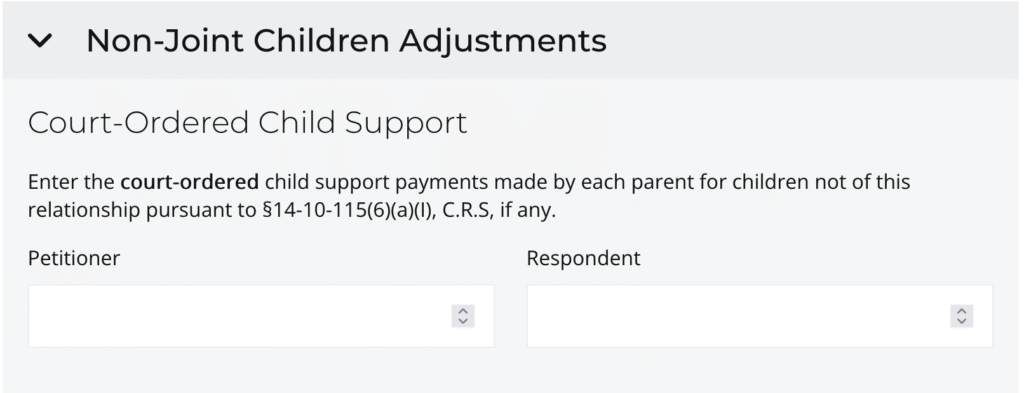

Court-Ordered Child Support for Non-Joint Children

Click on > Non-Joint Children Adjustments to open up the section. The first subsection to review is Court-Ordered Child Support.

If either party has court-ordered child support payments due for children from a different relationship, enter the monthly amount actually paid in this subsection. Remember, this adjustment is for payments made pursuant to a court order issued by a court. You will see the party’s adjusted gross income change in the sidebar to account for these payments.

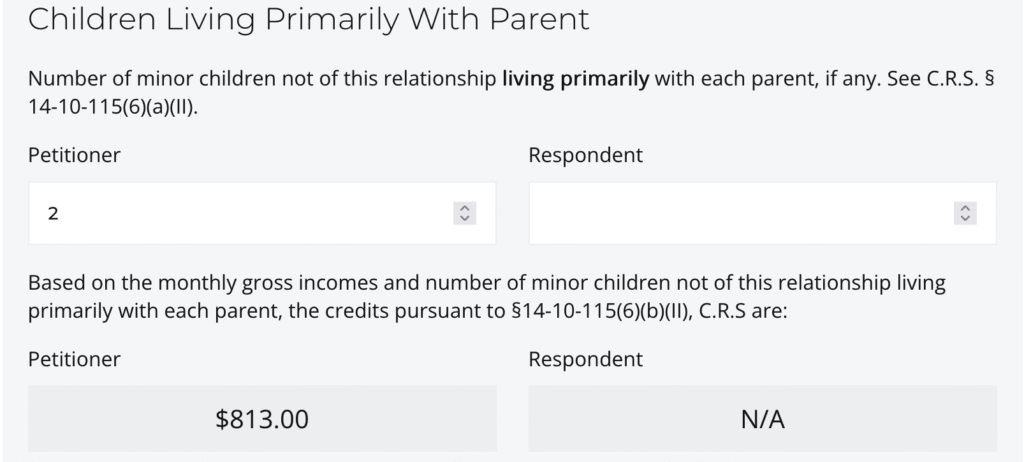

Non-Joint Children Primarily Living with Parent

If the party does not pay court-ordered child support because the party is the primary residential parent of the non-joint children, enter the number of minor non-joint children not of this relationship living primarily with each party. Remember, this is for children for whom the party has a legal responsibility to financially support – this typically would not include step-children unless the party has legally adopted them. If the non-joint children are living with the party in this case and with their other parent equally (50/50), that typically counts, but if that party is also paying court-ordered child support for those children, you could not receive credit both ways. When you list the number of non-joint children living with each party, the calculator will display the appropriate amount of credits, pursuant to the formula established by section 14-10-115(6)( b)(II), C.R.S..

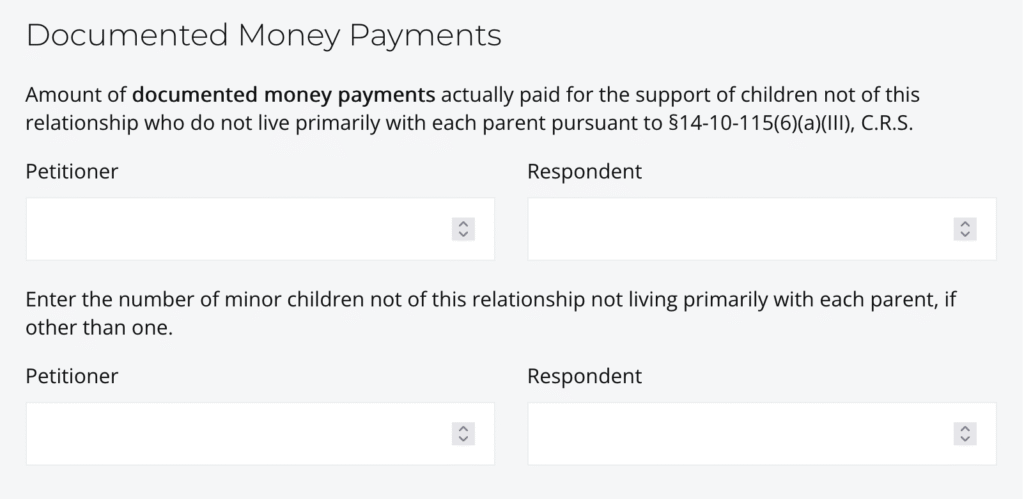

Documented Money Payments in Support of Non-Joint Children

If the non-joint children do not live primarily with the party and there is no court-ordered child support, enter the amount of documented money payments that party actually pays for the support of the non-joint children each month. Be prepared to show the other party and the court documentation showing these money payments – if there is no documentation of the money payments, the credit would not apply. The amount of documented money payments for this credit cannot exceed the credit the party would receive pursuant to the formula established by section 14-10-115(6)( b)(II), C.R.S. The calculator assumes there is at least one child when these fields are entered, but if the documented money payments are for more than one child, make sure you specify the number of children so that the cap is applied appropriately.

Save Your Progress and Continue

Click on the SAVE button to ensure your changes are recorded.

Continue on to the next post in the Guide to Calculate Child Support series at Part 5: Support Obligation Adjustments

Disclaimer

This guide is intended for informational purposes only and is not a substitute for legal advice. The information provided in this guide is generalized, and every case is different. If you are not sure whether a particular part of this guide should apply to you as described or not, please check with an attorney or limited license paralegal.