Part 1: Child Support Overview

Part 2: Get Started and Enter Essential Details

Part 3: Spousal Support and Spousal Maintenance Adjustments

Part 4: Non-Joint Children Adjustments

Part 5: Support Obligation Adjustments

Part 6: Comments, Settings, and Exporting

Spousal Support and Spousal Maintenance Adjustments

This is the third post in Legal Thunder’s 2025 Guide to Calculate Child Support in Colorado series and follows Part 2: Get Started and Enter Essential Details. This post assumes that the previous parts in the series have been reviewed and steps prior have been completed. This post will focus on calculating spousal support and adjustments related to spousal maintenance, also referred to as spousal support or alimony.

If you would like to calculate spousal support without child support, check out our How to Calculate Spousal Support in Colorado Guide (Coming Soon).

Spousal Maintenance For This Relationship

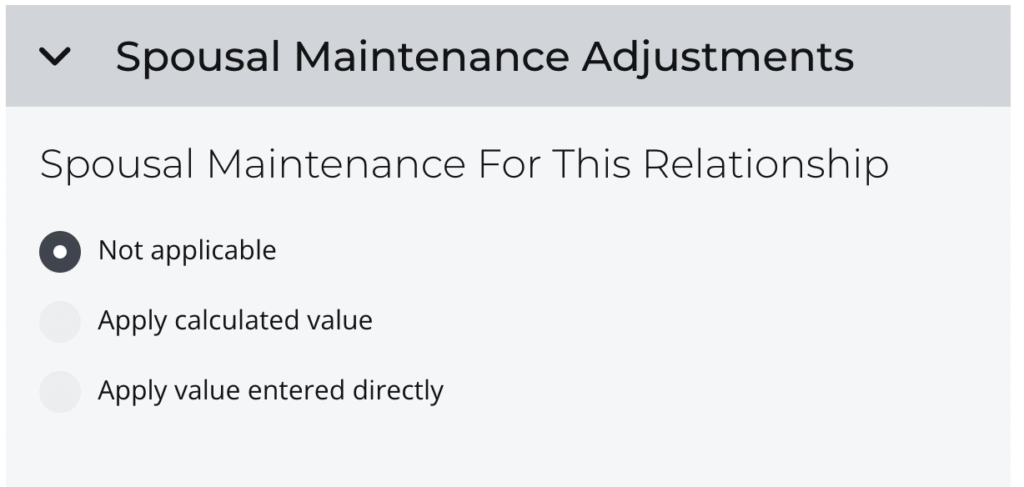

Click on > Spousal Maintenance Adjustments to open up the section. The first subsection to review is Spousal Maintenance For This Relationship.

If the spousal maintenance you pay or receive is not to or from the other party to this case, leave the Not applicable option selected and go on to the Spousal Maintenance Not Of This Relationship subsection.

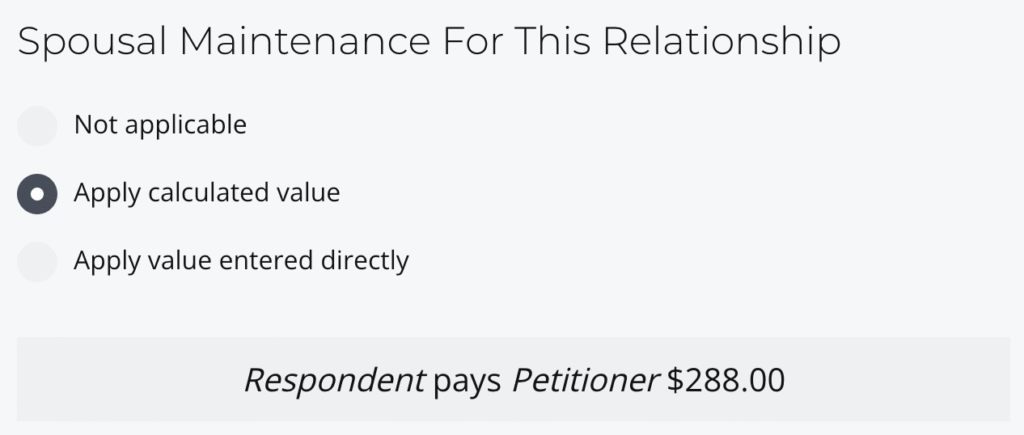

When spousal maintenance for this relationship applies, the calculator offers two ways to include this information. If you would like the application to calculate spousal maintenance based on the information entered for child support, select Apply calculated value. This option will apply the spousal maintenance obligation calculated from the income information you have entered and allow you to export a Spousal Support worksheet later on.

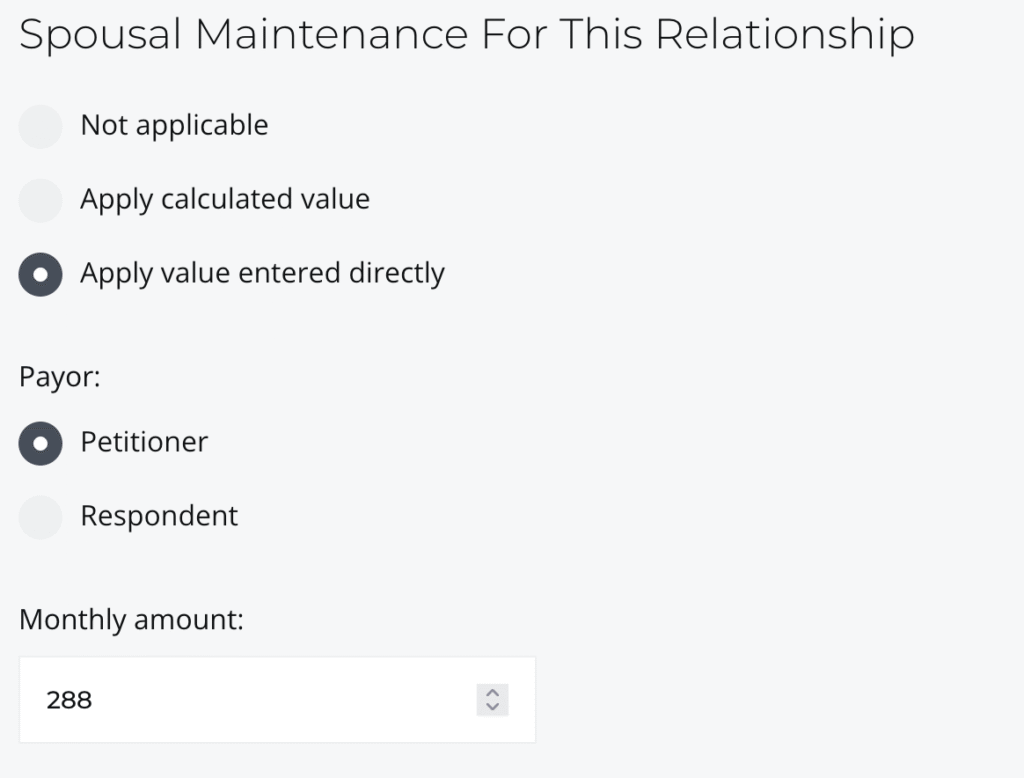

If you would like to enter a value that is different from the one calculated using the statutory formula, select Apply value entered directly. This option is appropriate if there is an existing spousal support order in place, or if you are exploring different scenarios or negotiating options. When applying value directly, select the Payor party and enter the Monthly amount.

Check if Spousal Maintenance Is Taxable

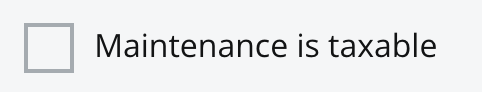

Spousal maintenance orders initiated from January 1, 2019, to the present are not deductible for tax purposes by the payor and are not taxable as income for the payee. If your spousal maintenance order was initiated prior to January 1, 2019, it is likely that your spousal maintenance is deductible for tax purposes by the payor and taxable as income for the payee. An older spousal maintenance obligation that was modified by court order since 2018 may have changed the taxability of the support, but only if the court order expressly changes the taxable nature of it. If you are unsure whether your spousal maintenance obligation is deductible/taxable, ask your attorney, limited license paralegal, or your tax professional.

Because spousal maintenance orders initiated since 2019 are not taxable to the recipient or deductible by the payor, our calculators assume that the spousal maintenance obligations you enter into the calculator are NOT deductible by the payor or subject to taxation by the recipient.

If your spousal maintenance IS deductible/taxable, you will need to indicate that it is taxable in the > Support Obligation Adjustments section. The option is displayed beneath the inputs for each category of spousal maintenance.

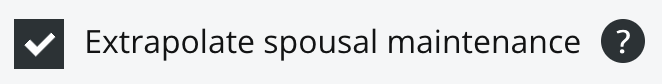

Extrapolation Beyond Guidelines

The spousal maintenance guidelines set by C.R.S. § 14-10-114(3) only apply to combined incomes up to $240,000 per year, or $20,000 per month. When the parties’ combined incomes exceed 240,000 annually, or $20,000 monthly, section 14-10-114(3.5), C.R.S., states that the formula set by section 114(3) does not apply and the Court must instead consider certain factors listed in section 114(3)(c). Nevertheless, it may be helpful to see what the amount would be, if the formula did apply to cases with combined incomes of $20,000 monthly or more. If your case has combined incomes of $20,000 monthly or more and you would like to apply the spousal maintenance formula beyond these guideline limitations, check the Extrapolate spousal maintenance option – just remember that the Court may choose not to follow the formula.

Maintenance Term

If you selected the Apply calculated value option and intend to export the Spousal Support worksheet, make sure to enter the maintenance term inputs. The maintenance term is the length of time the spousal support is effective for. The term is based on the length of the marriage and it can be entered by either the length of marriage directly, or the start and end dates of the marriage. Once entered, the calculator will display the resulting maintenance term based on the guideline. Pursuant to section 14-10-114(3.5), the Court may consider the guideline term or duration of maintenance for higher income parties, even if the parties’ combined incomes exceed the guideline cap.

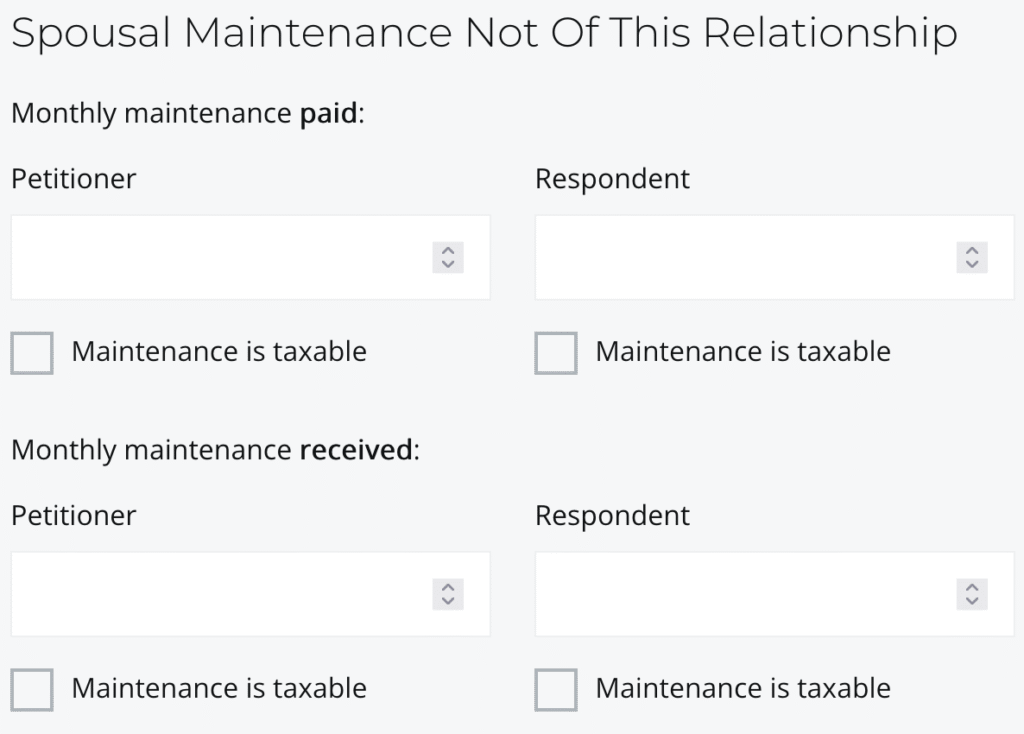

Spousal Maintenance for a Different Relationship

If either party pays or receives monthly spousal maintenance for a different relationship, enter the amount actually paid in the appropriate input. Make sure you check the “taxable” box if the spousal maintenance from the other relationship is taxable to the recipient and deductible by the payor.

Save Your Progress and Continue

Click on the SAVE button to ensure your changes are recorded.

Continue on to the next post in the Guide to Calculate Child Support series at Part 4: Non-Joint Children Adjustments.

Disclaimer

This guide is intended for informational purposes only and is not a substitute for legal advice. The information provided in this guide is generalized, and every case is different. If you are not sure whether a particular part of this guide should apply to you as described or not, please check with an attorney or limited license paralegal.